The Far-Reaching Effects of Auto Insurance Cancellation for Non-Payment in Florida.

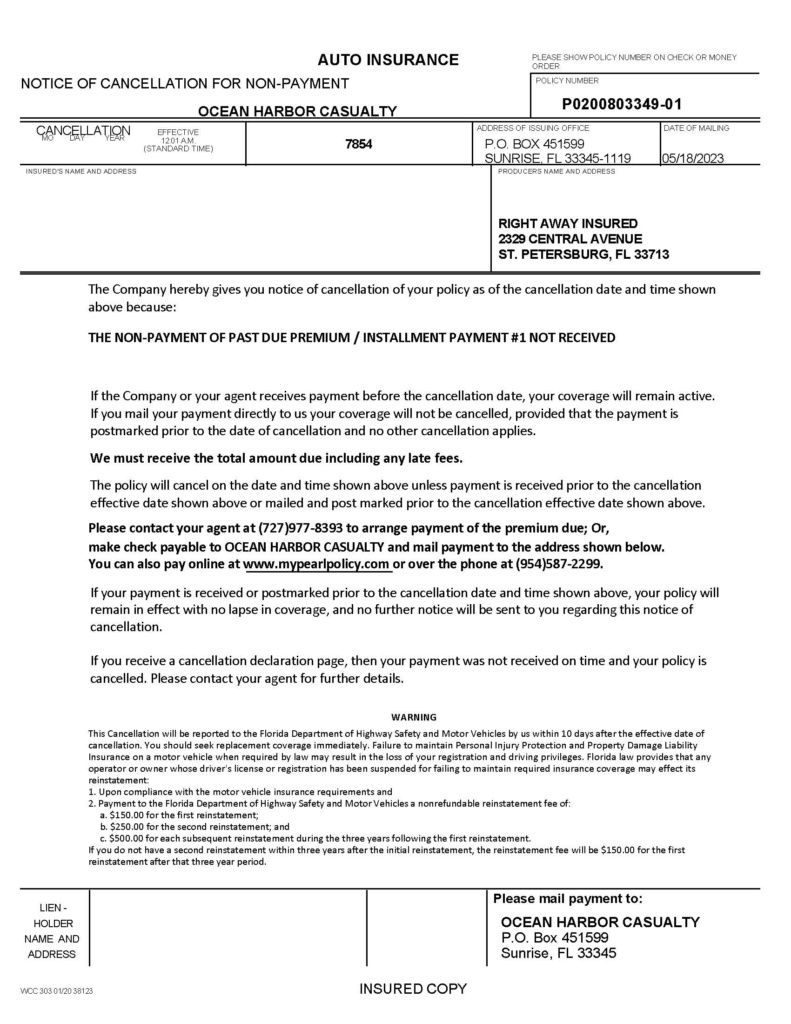

Auto insurance is not just a legal requirement in Florida; it is a vital safeguard that protects drivers, passengers, and other road users in case of accidents. However, failing to make timely payments on your auto insurance can lead to the cancellation of your policy. In Florida, the repercussions of having your auto insurance cancelled for non-payment can extend far beyond the immediate inconvenience. In this blog post, we will explore the effects this situation can have on your future insurance rates and explain how an independent insurance agency like Right Away Insured can provide valuable assistance.

1. Skyrocketing Insurance Premiums:

When your auto insurance policy is cancelled for non-payment, it sends a red flag to insurance companies. In Florida, insurance providers consider this cancellation as a sign of financial irresponsibility, leading to increased risk in their eyes. As a result, you will likely face significantly higher insurance premiums when you attempt to secure coverage again. This increased cost can place a considerable strain on your budget, making it even more challenging to reinstate your insurance.

2. Difficulty in Obtaining Future Coverage:

Aside from higher premiums, finding a new insurance provider after a policy cancellation can be a daunting task. Many insurance companies view a previous cancellation as an indication of risk and may be hesitant to offer coverage to individuals with this history. This creates a situation where you may have limited options for finding a policy that suits your needs. An independent insurance agency can play a vital role in helping you navigate this challenging landscape.

3. Negative Impact on Credit Score:

Non-payment of insurance premiums can have a negative impact on your credit score. Late or missed payments are often reported to credit bureaus, which can lower your credit score. A lower credit score can affect not only your ability to secure auto insurance but also impact other areas of your financial life, such as obtaining loans or mortgages. It is crucial to address the issue promptly to mitigate any long-term consequences.

4. Assistance from an Independent Insurance Agency:

In such circumstances, an independent insurance agency like Right Away Insured can be a valuable ally. Unlike captive agents who work for a single insurance company, independent agencies work with multiple insurers, providing a wider range of options. They can help you navigate the complexities of finding a suitable policy after a cancellation and secure coverage at the best possible rates. Independent agents have access to various insurance markets and can leverage their expertise to negotiate on your behalf, ensuring you receive the most competitive rates available.

Moreover, independent insurance agencies understand the nuances of insurance policies and can guide you through the process of rebuilding your insurance history. They can provide valuable advice on managing your finances effectively, highlighting steps to improve your credit score and demonstrate your responsible behavior to insurance providers.

Having your auto insurance cancelled for non-payment in Florida can have far-reaching consequences for your future insurance rates and overall financial well-being. The increased premiums, difficulties in obtaining coverage, and potential credit score impact make it imperative to address the situation promptly. Seeking assistance from an independent insurance agency like Right Away Insured can alleviate the challenges you may face. With their expertise, industry knowledge, and access to multiple insurers, they can help you find suitable coverage and minimize the impact on your future rates, ultimately putting you back on the road with confidence.

Call us today to see if we can help you save on your next insurance policy! 727-977-8393

Richard T. Feeney III

Chief Executive Officer

05/30/2023